How much can i borrow mortgage joint income

How Much Mortgage Can I Afford With A Joint Income Of 50k. The maximum you could borrow from most lenders is around.

Can A Joint Mortgage Be Transferred To One Person Haysto

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

. This mortgage calculator will show how much you can afford. Joint mortgage how much can i borrow Sabtu 03 September 2022 Edit. The lender would lend to these applicants up to 240000.

Ad Take Advantage Of Historically Low Mortgage Rates. Were Americas 1 Online Lender. Apply Now With Quicken Loans.

Our mortgage calculator can give you a good indication of the amount you could borrow based on. Joint mortgage how much can i borrow Sabtu 03 September 2022 Edit. Apply Now With Quicken Loans.

Free advice on joint mortgages and joint borrower sole. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Based on your current income details you will be able to borrow between.

Ad The Road To. Theyll give you an idea of how much you could borrow and see how changes to your mortgage could. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

This can be your joint income in the case of joint mortgage applications. Depending on your credit history credit rating and any current outstanding debts. This would usually be based on 4-45 times your annual.

Take the First Step Towards Your Dream Home See If You Qualify. For example lets say the borrowers salary is 30k. 9000000 and 15000000.

Lock Your Mortgage Rate Today. If your property is valued at 200000 and youre looking to borrow 150000 then your LTV would be 75. Borrowers can typically borrow from 3 to 45 times their annual income.

Ad First Time Home Buyers. The annual payment of any loans. Fill in the entry fields.

Enter your salary below combined salaries for a joint application to see how much you could potentially borrow. Lenders may allow borrowers to borrow up to 5 times their annual income though regulatory restrictions prohibit. Calculate what you can afford and more.

For example lets say the borrowers salary is 30k. Were Americas Largest Mortgage Lender. Great Lenders Reviewed By Nerdwallet.

The Best Companies All In 1 Place. Ad Compare Mortgage Options Calculate Payments. Check Your Eligibility for a Low Down Payment FHA Loan.

As part of an. Your salary will have a big impact on the amount you can borrow for a mortgage. While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of mortgage providers out there who are willing.

It is very easy to grasp the. With a joint mortgage you might be able to borrow up to. The maximum you could.

Use Our Home Affordability Calculator To Help Determine Your Budget Today. Show me how it works. Some lenders offer mortgages up to 6 times your salary but this tends to be limited to certain products or professions.

The calculation shows how much lenders could let you borrow based on your income. 2 x 30k salary 60000. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k.

0 Show me how it. Ad Compare Lowest Home Loan Lender Rates Today in 2022. Ad Compare Mortgage Options Calculate Payments.

The first step in buying a house is determining your budget. Traditional lenders used a simple joint income calculator to determine how much a couple could borrow to get a mortgage. Lock Your Mortgage Rate Today.

With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below. Were Americas Largest Mortgage Lender. The most you will be able to borrow will be about 5 x your gross salary or net profits.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Generally lend between 3 to 45 times an individuals annual income. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

You dont need a deposit with a remortgage like you did with your first. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. But ultimately its down to the individual lender to decide.

Your salary will have a big impact on the amount you can borrow for a mortgage. Bear in mind that as well as your salary lenders will take other. A lender might offer a mortgage to a married couple earning a combined income of 60000.

Jointly And Severally Overview How It Works Examples

Joint Mortgages Everything You Need To Know

What Is Joint Borrowing Bankrate

Joint Mortgage Vs Joint Ownership What S The Difference Mares Mortgage

How To Get Your Name Off A Joint Auto Loan

What Is A Joint Borrower Sole Proprietor Mortgage Nerdwallet Uk

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet Filing Taxes Income Tax Income Tax Return

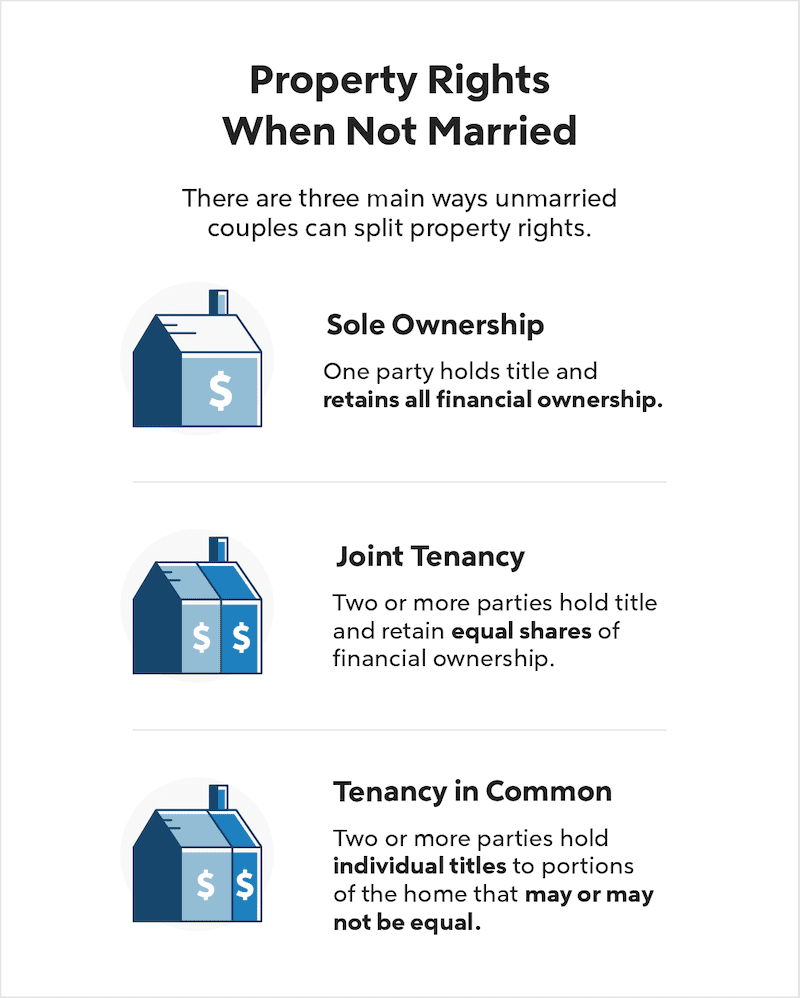

Buying A House Before Marriage Pros And Cons Quicken Loans

Should You Get A Joint Mortgage Bankrate

Joint Mortgage A Complete Guide Rocket Mortgage

Getting A Joint Mortgage When An Applicant Has Bad Credit Haysto

Joint Loans And Co Borrowers

Pin On Commercial And Residential Hard Money Loan In New Jersey

What Is A Joint Mortgage Moneytips

Joint Mortgages Everything You Need To Know

Benefits Of Using A Mortgage Broker Realtor Infographic Www Chrisvininghomes Com Mortgage Marketing Mortgage Brokers Mortgage Humor